Dominion Lending Centres Expert Financial - Lic # 12129 “Independently Owned & Operated”

#106 - 5780 Timberlea Blvd, Mississauga, ON, L4W 4W8

Shared Equity Program

Down Payment Assistance

Introduction

Together in 2023, we have helped over 900 families get in to homes, yet there are still many families who need assistance securing home ownership. If you as a realtor could help an additional 4 families obtain home ownership in the next 6 months, wouldn’t that be amazing?

Imagine helping a home buyer purchase a $1.67M home with only 5% down payment or a $2.5M home with 10% down payment!

If you are just as excited about this as we are, keep reading and let us tell you all about the shared equity program and how together we can get families into homes sooner.

Contact InformatioN

pHONE: 1 855 993- 5363

eMAIL: INFO@expertfinancial.ca

Overview

What is one of the biggest challenges homebuyers are facing today?

They are struggling to get into homes simply because they are not qualifying for a mortgage.

Another obstacle some are facing is that they do not have the sufficient down payment to get them into a home.

and bridge

the down payment gap by investing between 5% to 15% of the purchase price into the home and getting the client to a 20% total down payment. Ourboro will provide the funding towards a portion of the down payment and will benefit from the future appreciated value of the property. On a $1.66M property, Ourboro will invest up to 15% towards the clients 20% down payment and on a $2.5M property, they will invest up to 10% towards the clients 20% down payment.

Ourboro Can Help With that

Example 1:

- Purchase Price: $1.2M

- Clients minimum down payment: 5% ($60,000)

- Ourboro will contribute the remaining 15% ($180,000)

- Total down payment is 20%; however, client will only have to come up with 5%

Process Outlined

01

02

03

Get Pre Qualified with a mortgage professional

Home buyer will submit documents to the mortgage professional (us) and discuss home buying options. Once complete, we will start your application with Ourboro

Have an introductory call with Ourboro

Ourboro will reach out and discuss the program with the home buyer

Pre Approval Letter sent to Ourboro

Once Ourboro has discussed details with the home buyer, the mortgage professional will send a pre approval letter over to Ourboro

04

Follow up call with ourboro

Ourboro will call the home buyer and discuss the mortgage approval numbers. They will be provided with a Qualification Letter & will also be scheduled in for a zoom onboarding call with Ourboro.

05

Realtor Onboarding

Between step 1 and step 4, you as a realtor will need to be onboarded with Ourboro. We can assist with this.

06

07

08

09

10

Start House Shopping

After reviewing the home buying criteria, the homebuyer can begin looking for homes.

Make AN offer

Before making an offer on a property, the real estate agent must provide ourboro with the MLS Listing and the intended offer price / desired purchase price. Note. closing date must be a minimum of 40 days from the offer acceptance date.

mAXIUMUM bID pRICE

Before making an offer on a property, the real estate agent must also provide ourboro with the MLS Listing and the intended offer price / desired purchase price. Their investment team will review, along with internal evaluations and will determine a maximum bid price.

If the real estate agent cannot provide the details to Ourboro in time, it is recommended that financing conditions are put in place.

Offer Accepted

After the offer has been accepted by the seller, the realtor must advise the mortgage professional, along with Ourboro of the accepted offer.

Home inspection

Within 10 days of the APS being signed, a copy of the home inspection must be provided to Ourboro. Note, if the property is a apartment style condo that is less than 5 years old, no home inspection is necessary.

11

12

13

14

15

Ourboro Funding Letter

After receiving the home inspection report, Ourboro will work with the buyer to determine the final equity split and down payment contribution based on the home purchase price. This is all provided in the funding letter.

lEGAL CONVEYANCE TEAM

Home buyer will be introduced to Ourboro's legal conveyance team to review property conveyance and status certificate. Buyer must also obtain independent legal advise.

Conditional Mortgage Approval

The mortgage professional will be in touch with the buyer once the conditional approval comes in and to review any outstanding documents that are required.

Appraisal Report

Once the conditional approval has come in from the lender, the appraisal report will also be ordered by the mortgage professional.

Transfer of Ourboro’s SHARE OF DOWN PAYMENT Funds

Ourboro will transfer their down payment contribution amount to the lawyer in escrow under the buyer’s name. The funding letter & escrow confirmation may be used as proof of down payment funds with the lender.

16

Final ApproVAL

Once all conditions with the lender have been satisfied (a minimum of 10 business days from the closing date), the mortgage professional will receive an updated notice from the lender

17

18

19

20

Lawyer is instructed

Once all conditions have been satisfied with the lender, final instructions are sent from the lender to the lawyer to release the funds for the mortgage on the closing date.

Meet with Lawyer

Home Buyer will meet with their lawyers the week of their closing to sign paperwork and provide balance of funds.

iNSURANCE & Utility Bills

Home Buyer will need to arrange for insurance and to have utility bills for their new property registered in their names

Arrange for Movers

If needed, home buyer will need to arrange for movers to assist in having items transported to their new home

21

22

Closing Costs

The home buyer is ultimately responsible for all closing costs. This will be reviewed with the home buyer prior to closing. Ourboro will help contribute towards the land transfer taxes based on their proportion of equity interest.

Closing Day

On the closing date, the keys will either be released from the lawyer or realtor. This typically happens after 4pm as the funds need to reach the lawyers account prior to keys being released.

Eligibility Criteria

- Canadian citizens or permanent residents

- Property must be the primary residence

- Can be purchased individually or with a spouse or common-law partner. Cannot purchase with friends or other relatives. (Different rules may apply for Guarantors)

- Purchase price between $550,000 and $2,500,000

- Must be in one of Ourboros’ investment regions

- Must contribute between 5-15% toward the total purchase price of the home (down payment)

- Have the income and financial standing necessary to qualify for and support a mortgage. Home buyers must qualify for a mortgage using the standard stress test with one of the specified lenders.

- Property must be a resale, and cannot be a pre-construction or an assignment sale

FAQ

Who is Ourboro?

Ourboro is a Canadian-owned and operated real estate investment company. They help individuals and families fulfill their dream of homeownership by eliminating the down payment gap.

How Does The Program Work?

Where homebuyers cannot come up with a full 20% down payment, Ourboro (a Canadian owned real estate Investment Company) will invest in your home with you, by contributing up to $250,000 towards your down payment.

Is This A Loan?

No, this is not a loan as Ourboro is investing directly in the home with you.

How are payments made?

There is no interest or monthly payments. Ourboro benefits once the home appreciates and their equity share is given back to them.

How Does Ourboro Make Money?

Through the appreciation in the value of the home when the client sells or when they are bought out.

Which Geographic Areas Is This Available In?

- Dufferin

- Durham

- Guelph

- Halton

- Hamilton

- Kitchener / Waterloo

- London

- Peel

- Simcoe

- Toronto

- York

Is Ourboro registered on title?

No, they are not registered on title.

Is there a minimum beacon score (credit score)?

Yes, it needs to be 500+. The rate will be dependent on the credit score.

How Are Closing Costs Managed?

Ourboro contributes toward the land transfer tax, provincial and municipal, proportional to their equity interest in the home.

It is important to note that if the buyer qualifies for the land transfer tax refund for first time homebuyers, the refund may only be claimed against the portion of the land transfer tax that they paid.

What is the maximum down payment that will be provided?

The maximum down payment provided is $250,000 and will be dependent on purchase price & equity split

Is there a minimum or maximum purchase price?

Yes, the minimum purchase price is $550,000. The maximum purchase price is $2,500,000.

Is there a maximum time frame that I need to keep the home?

Ourboro can co own the home with you to match the amortization up to 30 years, after which they would need to be bought out or the house sold.

Is there a minimum number of days required for closing?

Yes, there needs to be a minimum of 40 days from the offer date to closing date.

What are the property criteria?

Property can be a condominium, townhouse, semi detached or single family home; however, the property must be a resale and not a preconstruction or assignment sale.

Can I purchase the property as an investment?

No, currently Ourboro is not co-investing in investment properties; however you are able to rent out a portion of the home, as long as you will also be living there as your principal residence.

Will Ourboro help with the deposit?

No, the deposit must be paid by the homebuyer (can be gifted from a family member) and Ourboro’s funds that they are providing will be release at closing.

What if I want to renovate?

When it comes to renovations, you’re free to make minor changes to the home entirely at your discretion. For major updates Ourboro does require that you let them know in advance, especially as you may qualify for a Renovation Credit. This means, if the renovation increases the home’s value, when the home is sold you get back some, or all, of the renovation costs.

Let’s Look At An Example

- Purchase Price: $1,000,000

- Mortgage: $800,000

- Clients down payment: 8% ($80,000)

- Ourboro will contribute the remaining 12% ($120,000)

- Total down payment is 20% ($200,000); however, client will only have to come up with 8% ($80,000) as the remaining 12% ($120,000) will be provided from Ourboro

- Since the client contributed 40% of the total down payment and Ourboro contributed 60% of the total down payment, the equity split in the home’s future appreciation would be 40:60

Purchase pRICE

$1,000,000

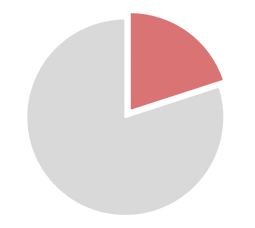

20% dOWN PAYMENT CONTRIBUTION

Ownership Shares

(eQUITY sPLIT)

Home buyer

($80,000)

8%

Ourboro

($120,000)

12%

Ourboro

60%

Home

buyer

40%

Down

payment

20%

Mortgage

80%

Now lets see what happens when the client sells

What Happens When A Client Sells Their Home

- Fast forward 3 years, and the client wants to sell their home

- Home sells for $1,191,016 (approximately 6% appreciation / year)

- Original purchase price was $1,000,000

- Original mortgage on the property was $800,000

- Client has paid $34,188 towards their mortgage over 3 years

- Balance of mortgage is $765,811

After 3 years, client sells the home for $1,191,016

$1,191,016

$765,811

$425,204

$34,188

$391,016

Sale Price

Less

Remaining Mortgage

Net Proceeds

Less

Principal Paid to Mortgage

Remaining Equity

cLIENT RECEIVES

$190,594

$156,406

+ $34,188

40% equity*

Mortgage Principal

Ourboro RECEIVES

234,609

$234,609

60% equity*

Ourboro

75%

*original down payment is included in this

What happens when selling at different price points

Sale Price

Purchase Price

$1,500,000

$1,000,000

$1,000,000

$1,000,000

$800,000

$1,000,000

Homeowner

Down Payment @ 8%

Equity Share @ 40%

Mortgage Principal Paid

Total Proceeds After Sale

$80,000

$200,000

$34,188

$314,188

$80,000

$0

$34,188

$114,188

$80,000

$0

$34,188

$34,188

Ourboro

Down Payment @ 12%

Equity Share @ 60%

Total Proceeds After Sale

$120,000

$300,000

$420,000

$120,000

$0

$0

$120,000

$0

$120,000

With no change

in the home value, no one will benefit from an equity split as there was no appreciation on the property. Both down payments are

returned.

With the home value decreasing, no one will benefit from an equity split. The home owner will walk away with their mortgage payments and both down payments are forfeited.

With the home value increasing by $500,000, both the homeowner & Ourboro have profited with the sale of the property

Buying With & Without Ourboro. A Comparison.

Buy Now

Without Ourboro

Buy Now

With Ourboro

Buy After 3 years of saving

Without Ourboro*

$1,000,000

$200,000

$800,000

$1,000,000

$50,000

$800,000

$1,191,016

$238,203

$952,812

Purchase Price

Clients Min Down Payment

Mortgage Required

* assumes 6% appreciation

over 3 years

Buying later, without Ourboro’s assistance would mean that the home buyer would have lost out on the yearly appreciation of the home and would have to come up with an even larger down

payment

Buying now, without Ourboro’s assistance would mean that the home buyer would need to come up with a full 20% down payment on their own and risk delaying their home purchase

Buying now, with Ourboro;s assistance would mean that the home buyer would only need to come up with 5% down payment and can get into a home

sooner

Scripting For Open House

There is a brand new program that helps people with down payment to give you a full 20% and allow you to qualify for more. You can now buy up to $1, 670 000 with 5% down-payment.

If you know anybody that's looking to purchase, and needs help with a down payment, please take one of these Flyers for them. Don't hesitate to ask me any questions.

Sample Sign Rider that can be put under a Listing / For Sale sign

Sample flyer / information sheet that we can provide for open houses or PDF for database

Scripting For Database & Past Leasing Clients

Hey, I wanted to reach out to let you know that there is a brand new program that help people with down payment to give you a full 20% and allow you to qualify for more. You can now buy up to $1.7 million with as little as 5% down payment.

If you know anybody that is looking to purchase that needs help with down payment, please introduce us. D not hesitate to ask me any questions.

Or, who do you know that is struggling with down payment to get in to the marketplace that we can help together with this program?

Sample Social Media Marketing

If you would like to have these customized, please email mortgages@anneecapital.com with your picture and brand colours if applicable

Contact InformatioN

pHONE: 1 855 993- 5363

eMAIL: INFO@expertfinancial.ca

Questions?

iF YOU HAVE ANY QUESTIONS OR NEED ANY ASSISTANCE, PLEASE reach out to our team

IF YOU NEED SIGN RIDERS OR CUSTOM FLYERS, LET US KNOW AND WE CAN ARRANGE.

iF YOU NEED A PRESENTATION COMPLETED FOR YOUR BROKERAGE, LET US KNOW AND WE CAN ARRANGE.

tHANK YOU!!

Contact InformatioN

pHONE: 1 855 993- 5363

eMAIL: INFO@expertfinancial.ca

Contact InformatioN

pHONE: 1 855 993- 5363

eMAIL: INFO@expertfinancial.ca